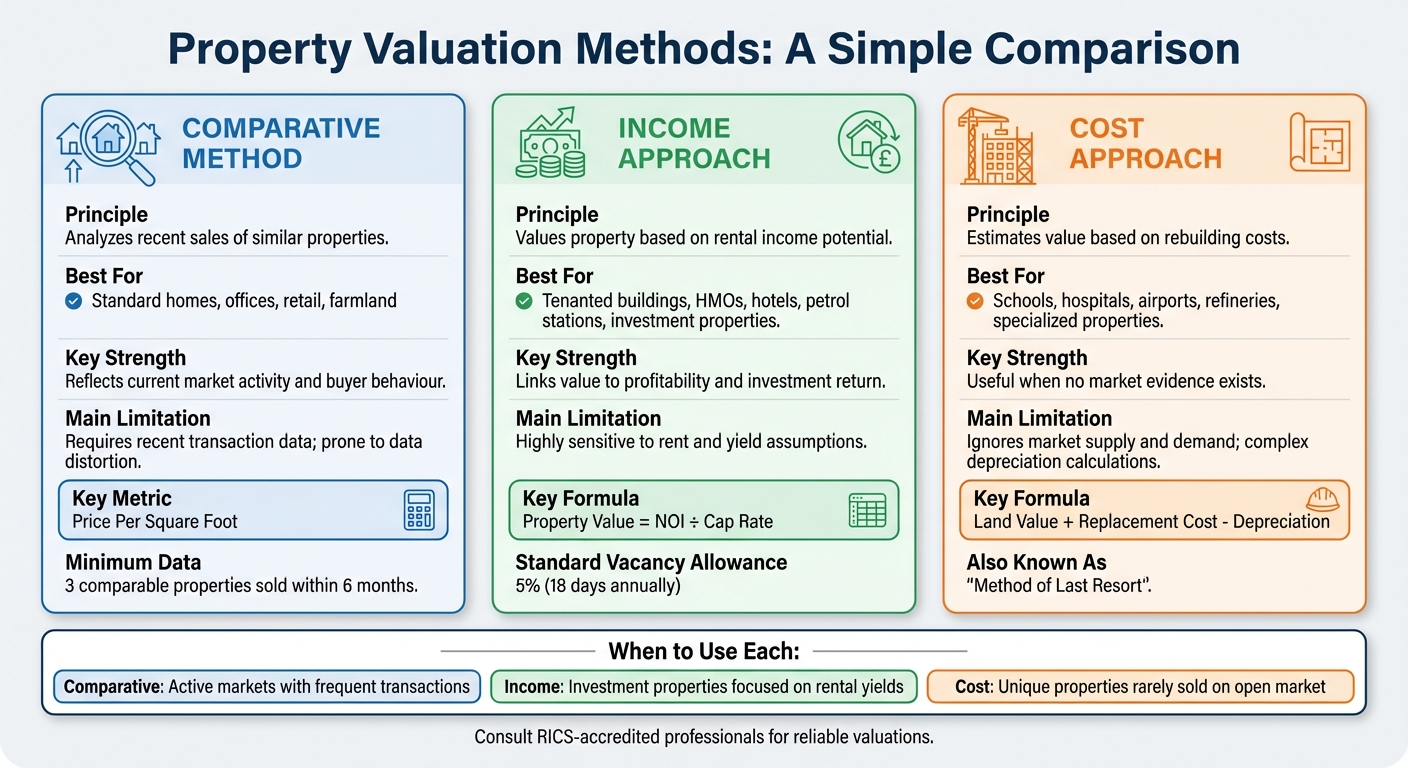

Whether you’re buying, selling, or investing in property, understanding valuation methods is essential. In the UK, three main approaches are used:

- Comparative Method: Analyses recent sales of similar properties. Ideal for standard homes and commercial units in active markets.

- Income Approach: Focuses on rental income to determine value. Best for investment properties like offices or multi-family units.

- Cost Approach: Estimates value based on rebuilding costs. Suitable for unique or specialised properties, such as schools or refineries.

Each method has its strengths and limitations, depending on the property type and available data. Selecting the right one ensures accurate valuations and informed decisions.

| Method | Best For | Key Strength | Main Limitation |

|---|---|---|---|

| Comparative | Standard homes, offices, retail | Reflects market trends | Requires recent transaction data |

| Income | Tenanted properties, investments | Links value to income | Sensitive to yield assumptions |

| Cost | Specialised properties | Useful with no market data | Overlooks supply and demand |

For reliable valuations, consult RICS-accredited professionals who follow industry standards.

UK Property Valuation Methods Comparison: Comparative vs Income vs Cost Approach

1. Comparative Method

Principle of Valuation

The comparative method relies on analysing recent, local transactions of similar properties to determine market value. Instead of theoretical models, it focuses on actual prices paid by buyers or tenants. This approach demands access to up-to-date, reliable data.

Jen Lemen FRICS, Partner at Property Elite, succinctly describes this approach:

“A comparable is defined as an item of information used during the valuation process as evidence to support the valuation of another, similar item.”

This principle underpins the detailed process outlined below.

Key Inputs/Calculations

To identify comparable properties – or “comps” – valuers gather data from sources like published databases, internal records, and consultations with estate agents. They then adjust for differences such as property age, condition, size, layout, and location. For instance, metrics like Price Per Square Foot or net effective rents are often calculated for commercial properties.

A minimum of three comparable properties sold within the last six months is typically required to establish a fair market value. For retail spaces, a “zoned analysis” might be conducted, where the front of the shop is valued higher than the rear.

Valuers follow a “hierarchy of evidence”, prioritising completed open-market transactions over asking prices or quoting rents, which may not reflect actual market conditions. They also verify comparables to exclude unusual or non-standard transactions.

Best-Suited Property Types

The comparative method is commonly used for both residential and commercial properties. It is particularly effective for:

- Standard residential properties: Houses and flats in urban or suburban settings with frequent transactions.

- Commercial units: Retail spaces, offices, cafés, factories, and warehouses with regular market activity.

- Land: Including farmland, agricultural plots, and development sites.

This method works best in active markets where recent sales data is readily available.

Advantages and Limitations

The comparative method’s main strength is its direct reflection of current market conditions, showing what buyers are willing to pay right now. It is the most widely used method globally and forms the basis for RICS valuations and mortgage lending assessments.

However, the method has its limitations. In markets with limited transactions or unusual sales (e.g., those involving “special purchasers”), it may not provide reliable results. Valuations can be particularly difficult in rural areas or for highly specialised properties, such as airports or oil refineries. Additionally, gaps in available data or a lack of market transparency can hinder accuracy.

| Factor | Impact on Comparative Valuation |

|---|---|

| Location | Proximity to amenities like shops, schools, and transport links heavily influences value. |

| Condition | Structural state and required repairs are carefully considered by RICS valuers. |

| Supply/Demand | High demand, such as in central London, can drive values significantly higher. |

| Lease Terms | Rental valuations must account for incentives and landlord-tenant dynamics. |

To ensure accuracy, valuers must gather a broad range of evidence rather than relying on a single data point, reducing the risk of valuation errors.

2. Income Approach

Principle of Valuation

The income approach, often referred to as the investment method, evaluates a property based on its potential to generate future income. Unlike methods that rely on comparing recent sales, this approach is particularly useful for tenanted properties where there is market data for rents and capital sales.

The Valuation Office Agency highlights an important distinction:

“A property’s ‘open market rent’ is the rent a property could reasonably achieve if leased to a new tenant. This isn’t necessarily the same as the current rent being paid.”

This distinction ensures that valuations reflect the current market rather than being tied to outdated lease agreements.

Key Inputs and Calculations

This method hinges on several key metrics. Gross Rental Income includes all income streams like rent, late fees, and additional charges such as pet or parking fees. From this, a standard 5% vacancy allowance – equivalent to about 18 days of lost income annually – is deducted to calculate Adjusted Gross Rental Income.

Next, operating expenses are subtracted from the adjusted income to determine the Net Operating Income (NOI). It’s important to note that NOI excludes costs like mortgage payments, capital expenditures, and depreciation. The Capitalisation Rate (Cap Rate), a key metric, measures the rate of return by dividing the NOI by the property’s value.

Two main methods are used for valuation:

- Cap Rate Approach: This formula is straightforward: Property Value = NOI ÷ Cap Rate For example, if a property generates an NOI of £9,720 and similar properties in the area have a 6% cap rate, the estimated value would be £162,000 (£9,720 ÷ 0.06).

- Gross Rent Multiplier (GRM): This quicker, though less precise, method multiplies the gross annual rental income by a local multiplier.

When expense data is scarce, the 50% Rule can serve as a rough guide, assuming that operating expenses consume about half of the adjusted gross rental income. For specialised properties like pubs, valuers may use the “Fair Maintainable Trade” (FMT) approach, which estimates income based on what a reasonably efficient operator could achieve, rather than relying solely on current figures.

These methods make the income approach particularly appealing for properties that prioritise rental yield.

Best-Suited Property Types

This approach works best for properties held with the aim of generating rental income. Examples include commercial real estate such as offices, retail spaces, and warehouses, as well as multi-family apartments and industrial units. It is especially effective when there is clear market data for rents and comparable sales.

For profit-driven properties like cinemas, theme parks, and pubs, a variation of the income approach – known as the Receipts and Expenditure method – is often used. This method values such properties based on business profitability rather than straightforward rental income.

Advantages and Limitations

The income approach aligns closely with investor priorities, focusing on cash flow and return on investment. By reflecting current market rents, it allows for easy comparison across different opportunities.

However, this method is sensitive to data accuracy. Even small changes in the Cap Rate can lead to significant variations in property value. Accurate knowledge of operating expenses is critical, as underestimating these can result in overvaluation. Additionally, the approach relies heavily on high-quality comparable data for rents and sales. In areas with limited transaction data or where expenses vary widely, the results may be less reliable.

| Method | Calculation Basis | Best Use Case | Main Limitation |

|---|---|---|---|

| Cap Rate Approach | Net Operating Income (NOI) | Professional investment analysis | Does not account for mortgage/financing costs |

| Gross Rent Multiplier (GRM) | Gross Rental Income | Quick market comparisons | Ignores operating expense variations |

| Receipts & Expenditure | Profit/Fair Maintainable Trade | Specialised businesses (cinemas, theme parks, pubs) | Requires detailed financial accounts |

3. Cost Approach

Principle of Valuation

The cost approach relies on the principle of substitution: no buyer would logically pay more for a property than it would cost to build a similar one from scratch.

Jen Lemen FRICS, Partner at Property Elite, summarises this concept well:

“The DRC [Depreciated Replacement Cost] method is based upon the assumption that the market will pay no more for the existing property than the amount it would cost to buy an equivalent site, plus the cost of constructing an equivalent building.”

In specialised valuations, this is often referred to as the tenant’s alternative – the hypothetical option to construct similar premises instead of renting. The VOA Rating Manual elaborates: “The hypothetical tenant has an alternative to leasing and paying rent because he can build similar premises; the ‘tenant’s alternative’.”

The formula for this approach is straightforward:

Property Value = (Estimated Land Value + Replacement Cost of Improvements) – Accrued Depreciation.

Key Inputs and Calculations

The cost approach follows a structured five-stage process:

- Estimation of Replacement Cost (ERC): This includes all expenses related to construction, such as materials, labour, site works, professional fees, and indirect costs like permits and architect fees.

- Adjusted Replacement Cost (ARC): Adjustments are made for factors like physical wear and tear, outdated design features (functional obsolescence), and external factors such as economic changes.

- Site Value: The land is assessed as if vacant and available for its optimal use, often by comparing recent sales of similar plots.

- Decapitalisation: A specific rate is applied to convert the total capital cost into an annual value. For instance, a school with a total cost of £1 million and a decapitalisation rate of 2.6% would have a rateable value of £26,000.

- Final Review: The final step ensures the valuation is realistic and consistent.

This methodology is particularly useful when comparable market data is lacking.

Best-Suited Property Types

The cost approach is typically used for properties where market data is scarce, earning it the nickname “method of last resort”. It is especially relevant for specialised properties that are rarely sold or rented, making comparison or income-based valuations impractical.

Examples include:

- Specialised industrial facilities like oil refineries or steelworks

- Public service buildings such as schools, hospitals, and libraries

- Unique infrastructure, including airports and chemical plants

These properties often lack rental income or comparable sales data, making the cost approach the most viable option.

Advantages and Limitations

The cost approach offers a systematic way to value unique properties by considering land, construction costs, and various forms of obsolescence. This makes it an invaluable tool when market evidence is unavailable.

However, it has its shortcomings. The method largely overlooks market dynamics like supply and demand and is based on the hypothetical scenario of constructing a modern replacement. Additionally, assessing obsolescence can be subjective and complex. The valuation is also highly sensitive to the decapitalisation rate – small changes in this rate can lead to significant variations in the final figure. For these reasons, the cost approach is rarely used in isolation and is often combined with other valuation methods to ensure a more balanced outcome.

| Aspect | Details |

|---|---|

| Primary Basis | Cost to rebuild or replace the property |

| Best Use Case | Specialised properties (e.g. schools, refineries) |

| Key Strength | Effective when no market data is available |

| Key Weakness | Ignores market supply and demand |

| Alternative Use | Often used for determining insurance coverage levels |

sbb-itb-b9291f4

RICS 7-tier Property Valuation Framework Webinar CPD – Approaches and Methods – Dr Tarek Madany

Comparing the Methods: Strengths and Weaknesses

Understanding the strengths and limitations of each valuation method is key to selecting the most suitable approach for a property assessment. Each method has its own niche, depending on the type of property and the availability of market data.

The comparative method is particularly effective in active markets with plenty of transaction data. It’s commonly used for residential homes, standard offices, or retail units because it reflects actual buyer behaviour and current market activity. However, it falls short when dealing with unique properties or in markets with fewer transactions. In such cases, finding comparable evidence can be challenging, especially if “special purchasers” have skewed the data by paying above typical market rates.

The income approach is ideal for investment properties where rental income drives value. It’s often applied to properties like HMOs, tenanted office blocks, or petrol stations, as it directly links value to profitability and cash flow. That said, this method is highly sensitive to small changes in rental income or yield assumptions, which can significantly impact the valuation. For specialised properties such as hotels or care homes, a variation called the profits method is used. This approach factors in business performance and intangible assets like goodwill but requires detailed financial analysis.

The cost approach is typically reserved for properties that rarely change hands, such as airports, schools, hospitals, or refineries. It uses a systematic framework based on replacement costs, making it useful when market evidence is scarce. However, this method doesn’t fully reflect market dynamics like supply and demand. Additionally, its reliance on complex depreciation estimates and sensitivity to decapitalisation rates limits its standalone application.

| Method | Ideal Property Types | Primary Strength | Main Limitation |

|---|---|---|---|

| Comparative | Residential homes, standard offices, farmland | Reflects current market activity and buyer behaviour | Needs a high volume of recent transactions; prone to data distortion |

| Income | Tenanted buildings, HMOs, hotels, petrol stations | Links value to profitability and investment return | Highly sensitive to rent and yield assumptions |

| Cost | Schools, hospitals, airports, refineries | Useful when no market evidence exists | Doesn’t fully account for market demand; involves complex depreciation calculations |

Selecting the right method depends on the property type and the available evidence. For standard properties in active markets, the comparative method is often the go-to choice. Investment properties, on the other hand, usually require the income approach. When dealing with specialised assets that lack market comparability, the cost approach is often used, but it’s typically combined with other methods to ensure accuracy.

Conclusion

After examining the core principles and uses of each valuation method, it’s evident that selecting the right approach depends on the type of property and your specific investment goals. The comparative method is most effective for standard residential and commercial properties with plenty of recent sales data. The income approach focuses on rental returns, making it ideal for tenanted properties or buy-to-let investments. Meanwhile, the cost approach is generally reserved for unique or specialised cases.

Each method serves a distinct purpose. Homebuyers and sellers often lean on the comparative method to ensure they’re dealing with fair market values. On the other hand, landlords and investors prioritise the income approach to confirm whether rental yields justify the investment. Choosing the right valuation technique is essential for accurate assessments and successful property transactions, as discussed earlier.

“No automated valuation can replace a valuation from a professional surveyor!” – PropertyData Team

For significant valuations – whether for mortgages, divorce settlements, or corporate asset reporting – it’s crucial to consult RICS-accredited professionals. These experts follow the Red Book Global Standards (effective from 31 January 2025), ensuring valuations are impartial, market-informed, and legally sound. Their expertise is especially vital for complex issues like structural defects or building safety, where automated tools fall short.

At Prince Surveyors, our RICS-accredited team offers precise, tailored property valuations across the UK. Whether you’re buying, selling, or investing, we provide the expert insights you need to make confident, informed decisions.

FAQs

Which property valuation method is best for my situation?

The best valuation method depends on both your goals and the type of property in question. For residential sales, the comparable method is usually the go-to choice. It looks at recent sales of similar properties to establish a fair asking price. If you’re dealing with income-generating properties, like rental flats or commercial spaces, the income approach works well, as it focuses on potential returns. Meanwhile, for new builds, unique projects, or assessing replacement costs after damage, the cost approach is often the most practical.

Here’s how to decide:

- Purpose: Selling a property? Use the comparable method. Evaluating an investment? The income approach is more suitable. Planning a development or reconstruction? The cost approach fits best.

- Available data: If you have solid sales data, the comparable method is ideal. For rental yields or cash flow projections, lean on the income approach. And if you have precise construction costs, the cost approach is your answer.

In practice, valuers often combine methods to improve accuracy. Matching the purpose, property type, and data available ensures you pick the right approach for your specific needs.

What challenges arise when using the comparative method to value rural properties?

The comparative method depends on having a substantial number of recent and similar property sales to act as reference points. However, in rural areas, this approach faces challenges due to the distinct characteristics of farms, agricultural land, and remote properties. Factors such as soil quality, landscape features, accessibility, tenancy agreements, and potential for development can vary greatly, making it difficult to find genuinely comparable sales.

On top of that, rural property transactions tend to be less frequent, and the available data is often outdated or not entirely relevant. This lack of reliable comparisons can result in valuations that are either too high or too low, increasing the risk of inaccuracies. While this method is still applied to rural properties, particularly those with development prospects, it is often combined with other valuation techniques to achieve more precise results.

Why is the cost approach often seen as a last resort for property valuation?

The cost approach is often seen as a last resort in property valuation. This method involves calculating the cost of rebuilding the property from the ground up, then subtracting depreciation. However, accurately estimating these figures can be tricky, and the results might not align with current market trends.

It’s most commonly applied when there’s a lack of reliable data on comparable sales or rental income. This makes it particularly useful for valuing unique or specialised properties, where conventional methods may not work as effectively. While it can offer some helpful insights, it’s generally less preferred in active markets where other methods provide a more accurate reflection of a property’s value.